Lesson Three - Setting up Tax

In this article we explain how to set up tax in Powered Now.

Tax doesn't have to be complicated. With Powered Now, you can simply set it up and forget about it. Powered Now supports all the major tax rates and you can even set your own rate if there is something we missed.

How do I set up my Tax (VAT)?

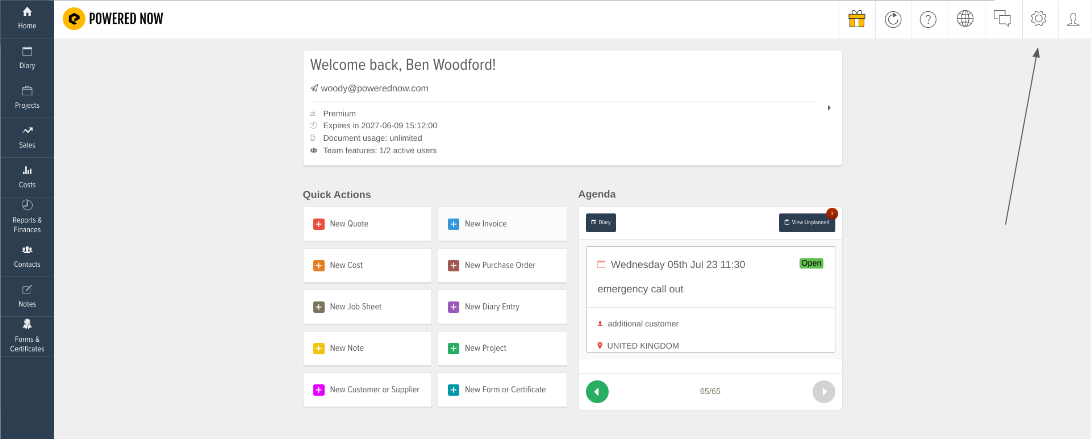

- Click on Settings.

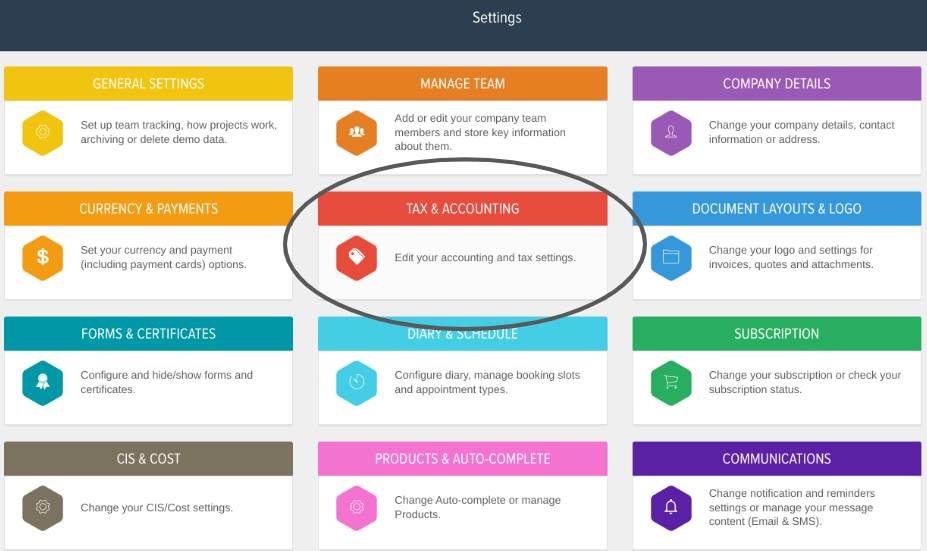

- Click on Tax & Accounting.

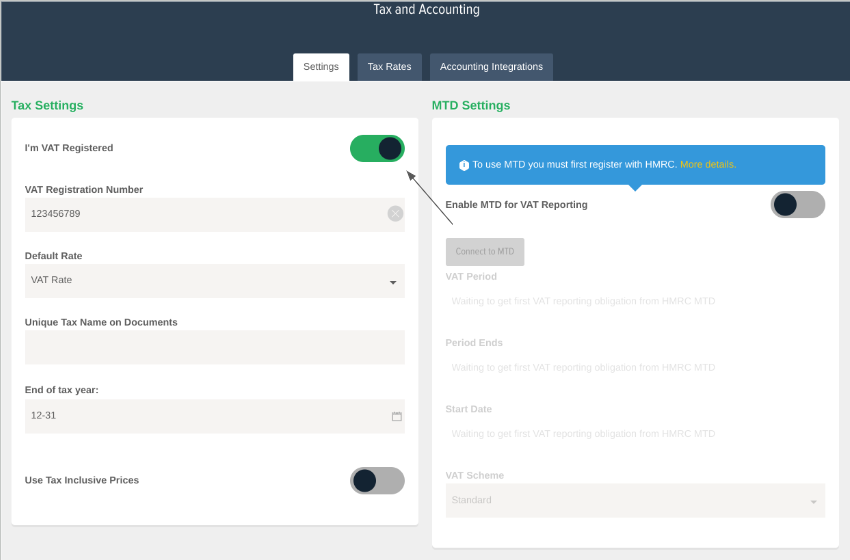

- If you are VAT registered, click on the slider and then add your VAT number and default tax rates.

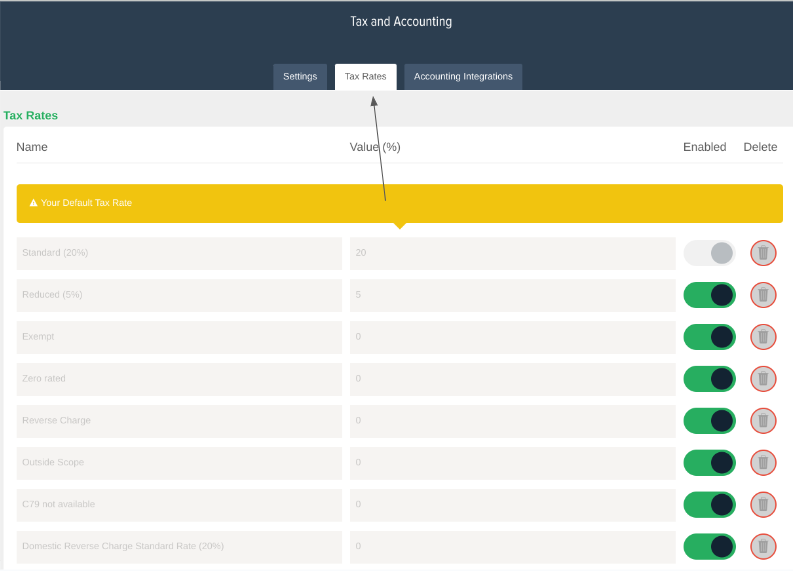

- Click on the Tax Rates tab to add your tax rates.

- Press Save.

![g-logo2.png]](https://support.powerednow.com/hs-fs/hubfs/g-logo2.png?height=50&name=g-logo2.png)