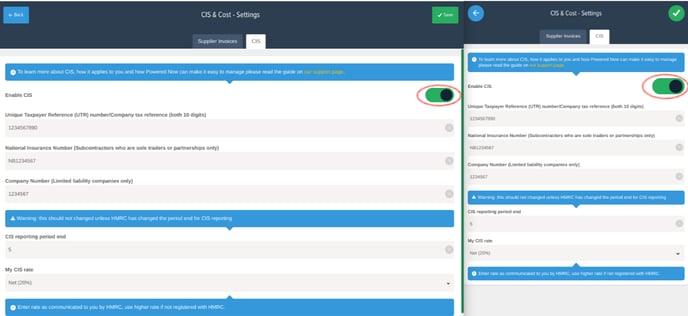

How to set up the Construction Industry Scheme

First of all, you will need to switch on CIS in your account.

To do this, go to:

Settings > CIS & Cost Settings > CIS

Switch on the Enable CIS switch to green.

Add your UTR number. (10 digit number).

Add your National Insurance or Company Number, depending upon your company type.

You can state your CIS reporting period and state your CIS rate (HMRC will let you know this).

Press Save.

CIS will now be turned on for you.

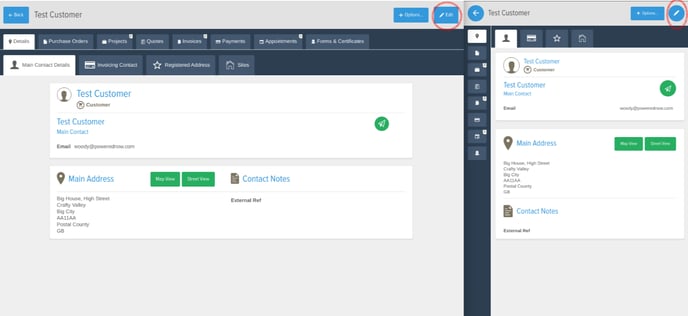

The next thing is to know who your customers and suppliers are that you are sending CIS to. You will need to turn CIS on for the customers and suppliers you are sending invoices to.

Click on Contacts.

Click on the blue Edit button (Blue pencil on the mobile app).

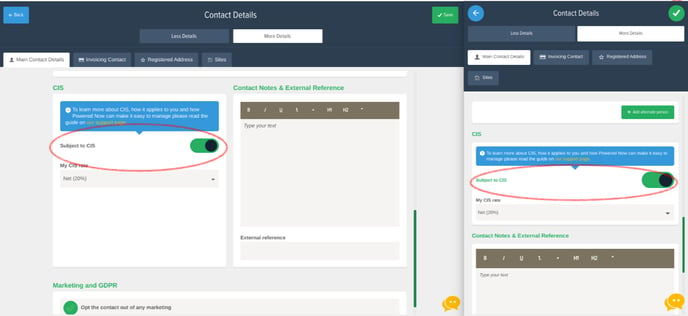

Scroll to the bottom of the page.

Switch on the CIS button within the customers or suppliers page.

Press Save.

When you create any CIS invoice, it will contain all the relevant data on it required for CIS.

Powered Now is fully HMRC CIS compliant to produce a CIS report.

Click on Reports & Finances in the sidebar.

Click on CIS Reports.

Enter the required information to produce a report.